When China began to change its development model and its economic model, even if it was not its political model, the price of its labor and logistics in the country was what made it the factory of the world. Decade after decade, this infrastructure has grown, as has the specialization of its workers and the cost of creating goods in this country.

Currently There are many countries where the labor cost is much lower than China, but they lack logistics and infrastructure. to create certain products, particularly those related to technology. There are countries, like India or Vietnam, which are trying to create by positioning themselves as an alternative to China, but it is not something simple.

[Tu nuevo coche te vigila tanto como tu móvil: por qué los fabricantes cada vez recopilan más datos de los conductores]

This is something that is perfectly seen in the smartphone sector, since China manufactures the vast majority of models, from low-cost clones from unknown companies to the most expensive iPhones. And the automotive sector is about to experience a similar evolution.

The Chinese paradox

China’s intention is to become not only the world’s largest automobile market, but also its largest manufacturer. To do this, it relied on the electric car, accumulating a large part of the knowledge but also the raw materials that it needs.

But it also specializes in software for the cars themselves. And this begins to be one of the key elements when choosing one model or another. A good example is Xiaomi’s car, the Xiaomi SU7, with a level of autonomous driving that not only reaches the achievements of Tesla, the most advanced Western company in this aspect, but surpasses them.

Interior of the Xiaomi SU7 with Apple Carplay on the touchscreen

Free Android

Today, China is not fighting to compete in the major leagues, but rather to be the lead, dominant economy in an increasingly important sector. And this by creating vehicles whose cost exceeds those manufactured in Europe or the United States.

Software is key

Once it is clear that Western manufacturers cannot compete on price with Chinese manufacturers, it’s time to think about how to proceed. And software is key. Tesla knows this and that is why it has invested so much money and effort into creating software at the highest level. This is the same thing that Apple did when launching the iPhone, focusing much more on the software than on the technical characteristics of its first mobile phone.

Tesla app

Free Android

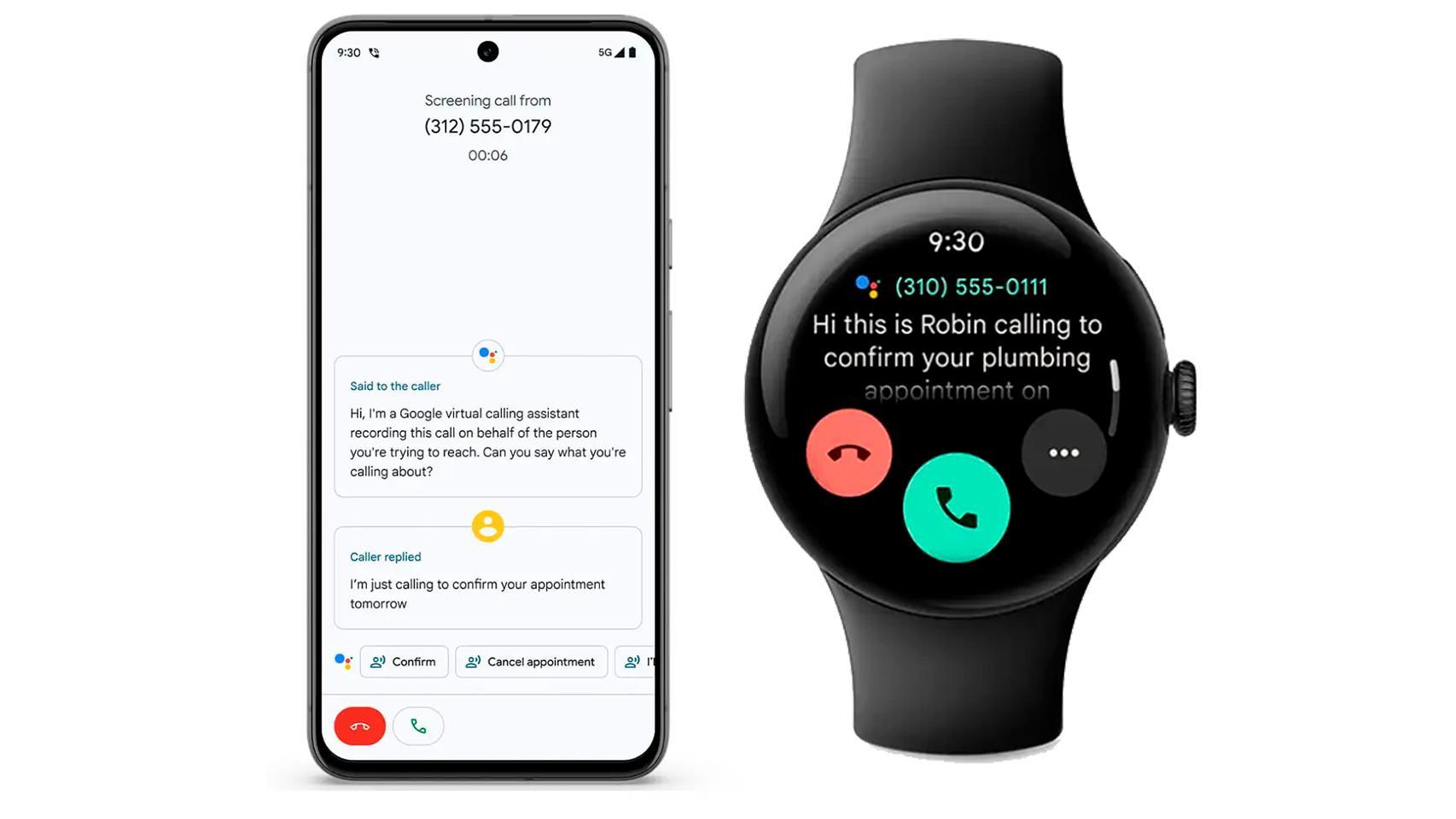

Young buyers increasingly appreciate more details on connectivity above other more classic aspects, such as construction quality, sound insulation, etc. And that means manufacturers’ priorities need to change. Not being able to open the car with your cell phone, not being able to geolocate it or not being able to acclimatize it before getting in is a disadvantage just like not having power steering or electric windows in the cars was. previously.

And it’s not just Xiaomi, which has incredible leverage in HyperOS to be able to sell its car. Brands like NIO or Polestar have directly decided to release their own smartphones, designed to better integrate with their cars. It also allows them to add value to their cars, stopping a price war that doesn’t sit well with the brands.

Western software

The question is whether traditional brands will be able to compete in such unfamiliar territory. Cariad, the Volkswagen group’s software bet was an absolute failure and now they are betting on allying with Vivo, and the rest of the European brands have not shown enough knowledge to compete with Chinese brands.

Those who succeed best, like Renault, do so by opting for Google, with an interface and functions comparable, or even superior, to those of Tesla or Chinese brands. But this means losing control of software development, which can be dangerous in the long term.

Interior of the new electric Renault 5 with Android Automotive

Free Android

The question is: are there alternatives? A few decades ago, in Europe, advanced mobile operating systems such as Symbian, Maemo or Meego were developed, but this stage is outdated and currently the United States is leading in this area. Apple also offers software for cars, but the dangers of adopting them are the same as those discussed with Google.

Alliance with China

Brands like Toyota have partnered with Chinese companies, like TENCENT, to develop software solutions to keep their cars competitive and attractive in a market that is changing faster than ever. Other manufacturers may need to do the same, if only to be able to continue to compete without having to raise prices.

BYD car interface

Free Android

Connected vehicles are still in their infancy, it’s 2008 of mobile operating systems, when neither Android nor iOS were as dominant as they are today. Brands still have room to make software a key experience in the development of their cars.

Of course, they must not make the mistake of wanting to please their shareholders in the short term or to obtain profits through abusive subscriptions. All current giants can be forgotten in a few years, as happened to Siemens, Nokia or BlackBerry in the consumer electronics sector. Whether Mercedes, Audi or the Stellantis group do not end up the same way depends largely on the decisions of their leaders and, to a large extent, on the actions taken by the European Union in the face of the imminent change in the winds of the global economy.

Table of Contents