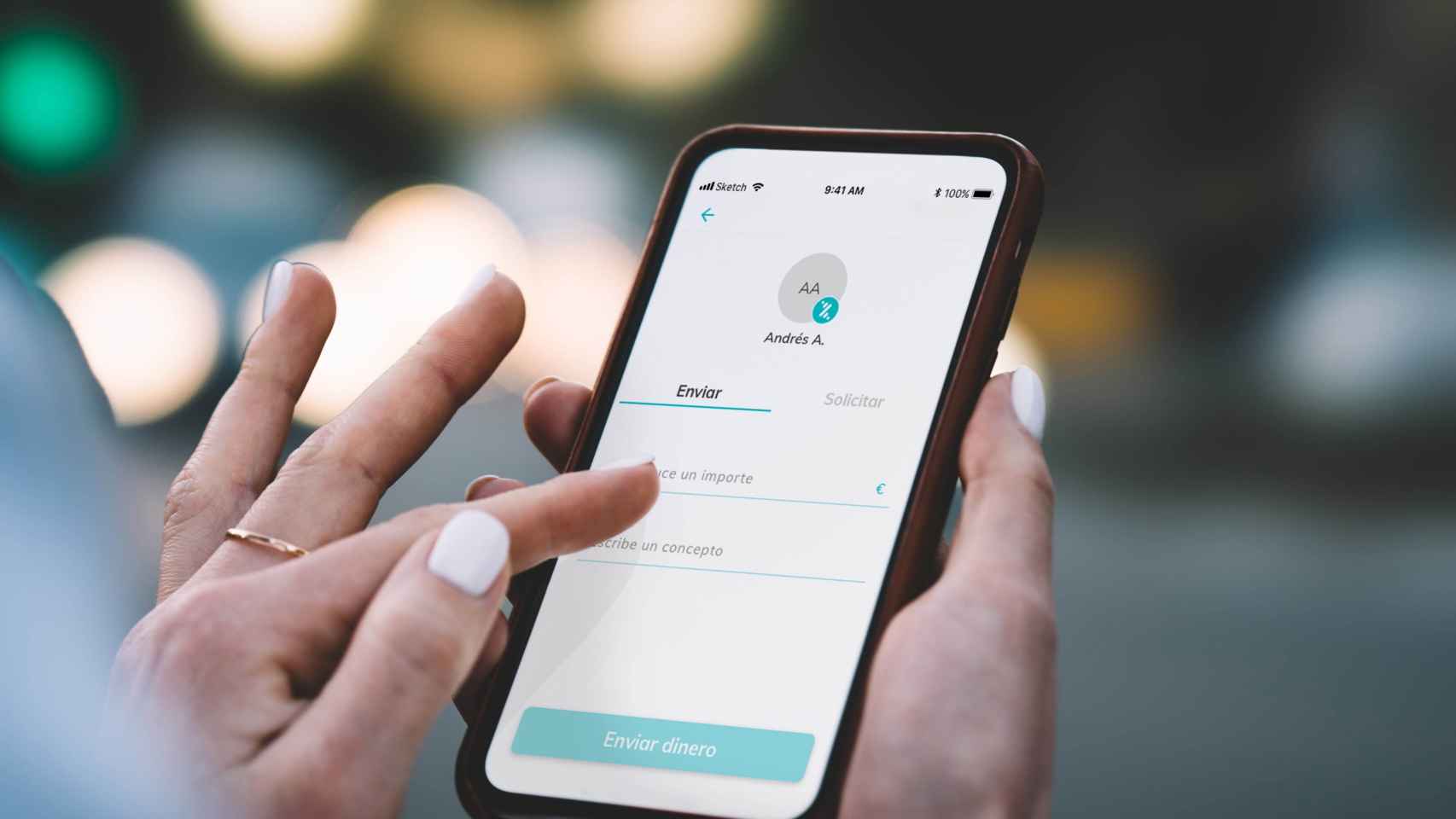

Since it began to be implemented in Europe in 2019, the payment method via Bizum has become essential in our country, where more than 20 million people regularly use the application. Its convenience and speed of use make it a perfect option for sending money to family and/or friends, but also for making payments to businesses in just a few seconds.

More than thirty banking entities have implemented this versatile and useful payment platform, although its use presents a series of particularities and rules that are worth knowing. For example, It is not possible to send more than 60 monthly money transfers, except in the case of companies and businesses with this system, which, where applicable, can use it unlimitedly.

On the other hand, it is also worth knowing that the maximum amount of money that can be sent via Bizum is worth 1,000 dollars, and which the tax authorities set at 10,000 dollars the limit to have the obligation to declare the amount entered via this platform. If it is higher, the Treasury emphasizes that it must be included in the tax return.

Can a money transfer via Bizum be cancelled?

Bizum is an instant payment method where you simply enter personal passwords and indicate the amount and the recipient’s phone number to send the money in just a few seconds. This way of working has many advantages, but also some disadvantages, the main one being the impossibility of canceling the Bizum.

[5 trucos para usar Bizum en España y enviar dinero]

This is because the recipient receives the money immediately, so if there is an error sending the money, that money will now belong to the person who was sent. If you find yourself in a situation where you have sent When giving money to someone else by mistake, you have three options:

- Talk to the other person: The first thing you can do, in case of an error, is to contact the telephone number where you made the bizum to ask them to return it to you. On the payment receipt you will be able to find out the phone number to which you sent the money.

- Request money sent: Another option is to use Bizum’s own service to request the money sent. In this way, the recipient will receive a notification in which a sum of money will be requested from them. As in the previous case, everything will depend on the good faith of the other person.

- Contact the bank: There is also the option of calling the bank to explain what happened and tell them it was a mistake. The bank will tell you the steps to follow to try to recover your money.

How to protect your money when using Bizum

Beyond the fact that you can make a mistake in indicating the phone number of the recipient of your bizum, it is important to be aware that cybercriminals use very different methods to try to scam and steal money from their victims, and before the rise of this payment method phenomenon, they try to take advantage of it to commit their illicit acts. For this reason, anyone using Bizum should Be vigilant and be wary of the notifications you receive.

[Hacienda te vigila cuando usas Bizum: así puedes evitar multas de hasta 150.000 dollars]

One of the most used scams in recent months is the one that asks for a disguised deposit payment so that it can be accepted quickly. Sometimes, these criminals contact the victim to ask them to return a payment mistakenly sent by Bizum, even pretending to be friends or acquaintances. The user must give consent to carry out the transaction, so it is essential to always stop to carefully read the notifications received and always ensure the veracity of what they say.

On the other hand, it is recommended not to click on links whose origin is unknown, but it is also necessary to avoid transactions from people who are not part of the contact list, and in no case provide access data. Likewise, Social Security insists on reminding that no official body makes payments through Bizum, an aspect to take into account to avoid being the victim of an attempted scam.

The Bizum concept

Payment via Bizum has many advantages, but also certain disadvantages, one of which concerns the jokes usually written in “concepts” when a payment is made.

[La nueva estafa por Bizum que amenaza con clonarte la cuenta: cuidado si te llega dinero ‘por error’]

The “concept” is an option integrated into the payment platform which allows you to include a brief message to specify what the payment is for. Since many of these payments are made between friends or acquaintances, this text field is often used to make jokes. However, you have to be careful what you put, since banking entities are obliged to monitor these transfers in accordance with regulations relating to the prevention of money laundering and terrorist financing.

Therefore, to avoid possible calls from the bank, it is advisable to avoid certain words or terms when writing the concept.

Follow topics that interest you