With the recent news that GM plans to ditch Apple CarPlay, anyone invested in Apple’s ecosystem might be wondering if other automakers will do the same. Apparently, you won’t see Ford jumping on this bandwagon, as the company told 9to5Mac that it remains committed to CarPlay.

“We continue to offer Apple CarPlay and Android Auto because customers appreciate the capability that allows easy access and control of their smartphone apps, especially our EV customers, as some EVs currently do not offer these features. “, a Ford spokesperson told 9to5Mac.

9to5Mac points out that Ford’s executive ranks include Doug Field, who was formerly at Apple as vice president of special projects. Speculation was that Field oversaw the long-rumored Apple Car before leaving for Ford. Field’s influence and insight into the development of Ford’s electric vehicles may therefore have played a role in Ford’s involvement.

Ford’s statement may reassure Apple users, especially after GM’s announcement, which comes at a time when EV companies (such as Tesla and Rivian) do not support CarPlay or give not feature priority with Apple apps in its automotive software UI. development. Tesla only recently started supporting Apple Music in its cars.

Apple

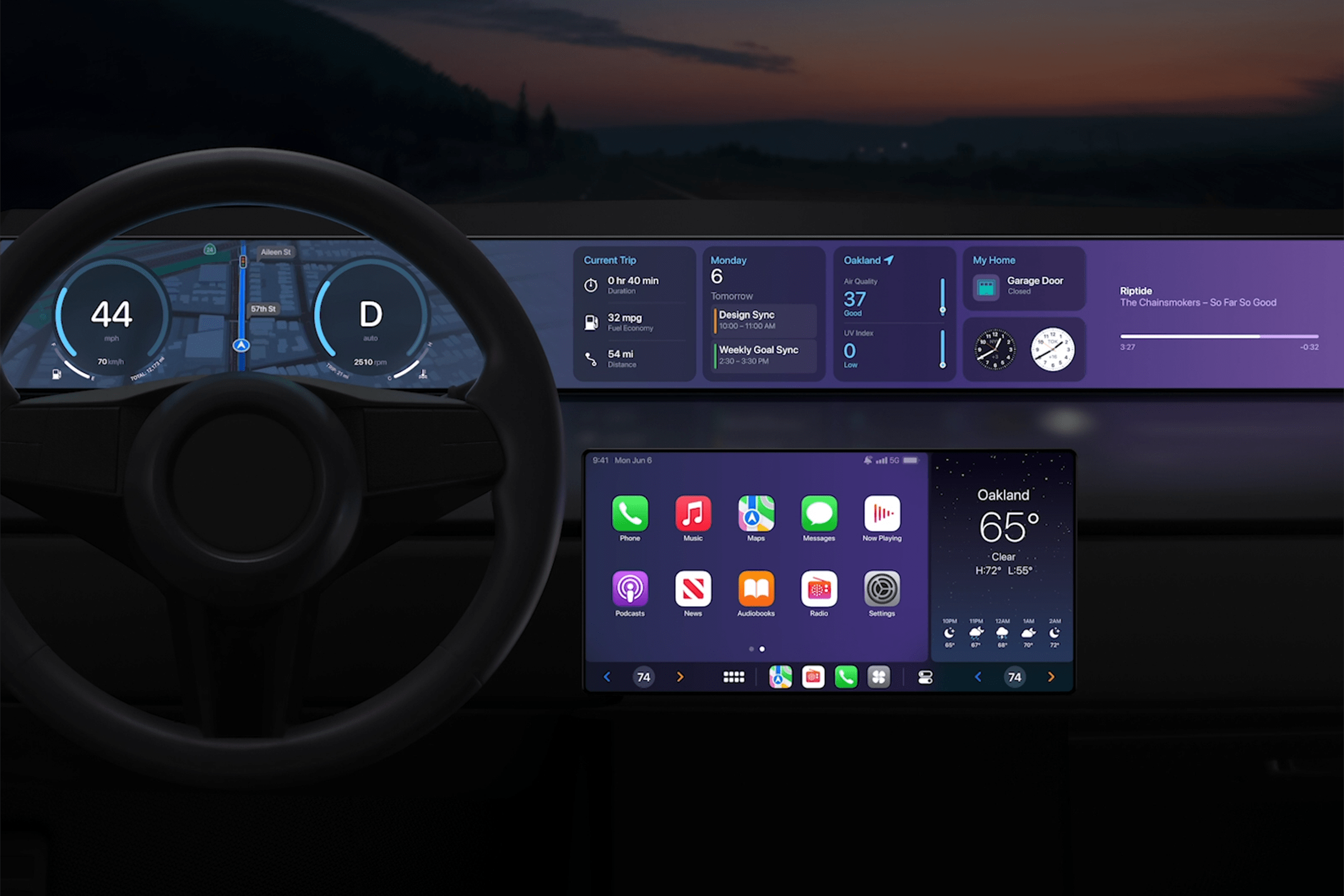

At last year’s WWDC, Apple’s keynote included a preview of a new CarPlay experience, one in which CarPlay was displayed as the full dashboard experience, including the indicator speed, engine speed, temperature, fuel/battery gauge, etc., in addition to entertainment and navigation tools. Apple said a slate of vehicle announcements for the next generation of CarPlay will arrive in late 2023.

Ford hasn’t specified the extent of its CarPlay commitment, so we don’t know if Ford is banking on the CarPlay experience. But Ford is making a big play with its electric vehicles. In 2021, the company announced that it plans to invest $22 billion, but will lose $3 billion this year in electric vehicle sales despite sales growth. So, to help Ford achieve profitability, it can see the implementation of CarPlay as a way to reduce development costs and attract customers.

Companies such as Tesla and Rivian have software development as a much larger part of their automotive production, so they use their proprietary dashboard software. GM plans to use a new Google in-car navigation system, and it could feel a backlash over its CarPlay decision. The trend is towards an in-car system that doesn’t rely on a smartphone, which also means the car will have built-in connectivity. These new in-car systems (including CarPlay) could also be a way for automakers to create a new revenue stream based on subscriptions, where fees are paid for access to navigation systems and streaming entertainment services.